Hello world! This is Zorro Trader.

Algorithmic trading is the use of computer programs to execute trading decisions in financial markets. It is an automated process that is used to execute large numbers of trades at high speeds and with minimal cost. Traders who engage in algorithmic trading usually make use of algorithmic trading systems, such as Zorro Trader, to automate their trading decisions. Algorithmic trading has become increasingly popular over the last several years. This is due to its accessibility and the potential to optimize returns.

What is Zorro Trader?

Zorro Trader is an algorithmic trading platform that is developed by the company oP Group from Germany. It is a professional platform that allows traders to design, customize, and backtest algorithmic trading strategies. Zorro Trader supports multiple trading strategies, including arbitrage, scalp, trend-following, and market-making. Furthermore, users can automate their strategies in order to execute them in live markets.

Algorithmic trading provides traders with a number of benefits over manual trading. First, algorithmic trading reduces transaction costs while increasing market liquidity. Algorithmic trading is able to achieve this by placing a high volume of trades that can in turn create more market movement. By increasing market liquidity, traders can buy and sell assets at better prices.

Second, algorithmic trading enables traders to make well-informed trading decisions. This is because algorithms are able to take into account a variety of factors in order to make their decisions. By running through all the relevant data, algorithms are able to make decisions that reflect the current market conditions more accurately.

Third, algorithmic trading allows traders to react quickly to market conditions. The high speeds and minimal cost of algorithmic trading enable traders to remain in the market and take advantage of opportunities as and when they arise. A trader’s speed to react is important in a rapidly evolving market, and algorithmic trading provides traders with the ability to optimize their returns. Fourth, algorithmic trading reduces the risk of human error. Traders are human, and therefore prone to errors. By automating trading decisions, traders are able to minimize the potential for errors. This in turn can have a significant impact on the success of trading strategies.

Challenges Associated with Algorithmic Trading

However, there are several challenges associated with algorithmic trading. First, algorithmic trading is highly technical. It requires traders to have a goo d understanding of computer programming languages, markets, and trading strategies. This is a difficult task for the average individual. Second, algorithmic trading is highly capital intensive. Many trading strategies require large amounts of capital in order to be successful. This can be a barrier to entry for smaller traders. Third, algorithms can be prone to errors. Despite the potential for decreased human error, algorithms are not infallible.

There is the potential for errors due to coding mistakes or market changes that the algorithmic trading system is not aware of. Fourth, algorithmic trading is less reliable in volatile markets. Algorithms are designed to take advantage of opportunities in trending markets. However, in volatile environments, algorithmic trading can become unreliable due to the unpredictable nature of markets. Fourth, algorithmic trading can be expensive in terms of costs. Algorithmic trading incurs costs for software licensing, data feeds, and server fees.

Zorro Trader for Algorithmic Trading

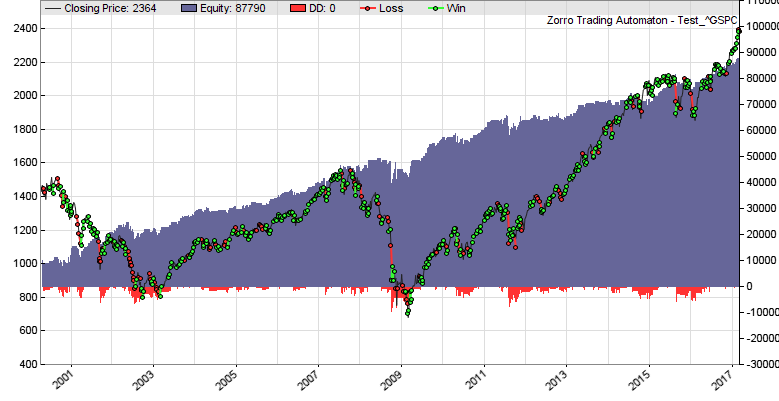

Despite the challenges associated with algorithmic trading, Zorro Trader provides traders with powerful features that make it easier not only to develop strategies but to execute them as well. Zorro Trader’s scripting language is a powerful feature that allows traders to develop sophisticated strategies. The scripting language enables traders to create sophisticated rules and algorithms to make trading decisions. Furthermore, the scripting language supports both C and C++, making it easy for traders to integrate external libraries into their strategies. In addition, Zorro Trader provides an integrated backtesting and optimization engine. This makes it easy for traders to backtest their trading strategies and optimize them to take into account various market parameters.

Finally, Zorro Trader’s integrated data feed allows traders to access real-time data from multiple markets across the world. This makes it easy for traders to execute their strategies in real-time. Algorithmic trading has become increasingly popular over the last few years due to its potential to optimize returns while minimizing transaction costs. Zorro Trader is a powerful algorithmic trading platform that provides traders with a range of features that make it easier to develop, backtest, and execute strategies. However, as with any type of trading, there are challenges associated with algorithmic trading. It is important that traders understand these challenges before embarking on an algorithmic trading journey.

1 Comment on "Hello world! This is Zorro Trader."

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.